Affirm Information

Affirm Overview and Application Process

- Buy and receive your purchase right away, and pay for it over several months. This payment option allows you to split the price of your purchase into fixed payment amounts that fit your monthly budget.

- If Affirm approves your loan, you'll see your loan terms before you make your purchase. See exactly how much you owe each month, the number of payments you must make, and the total amount of interest you’ll pay over the course of the loan. There are no hidden fees.

- The application process is secure and real-time. Affirm asks you for a few pieces of information. After you provide this information, Affirm notifies you of the loan amount that you’re approved for, the interest rate, and the number of months that you have to pay off your loan -- all within seconds.

- You don’t need a credit card to make a purchase. Affirm lends to the merchant directly on your behalf.

- You may be eligible for Affirm financing even if you don’t have an extensive credit history. Affirm bases its loan decision not only on your credit score, but also on several other data points about you.

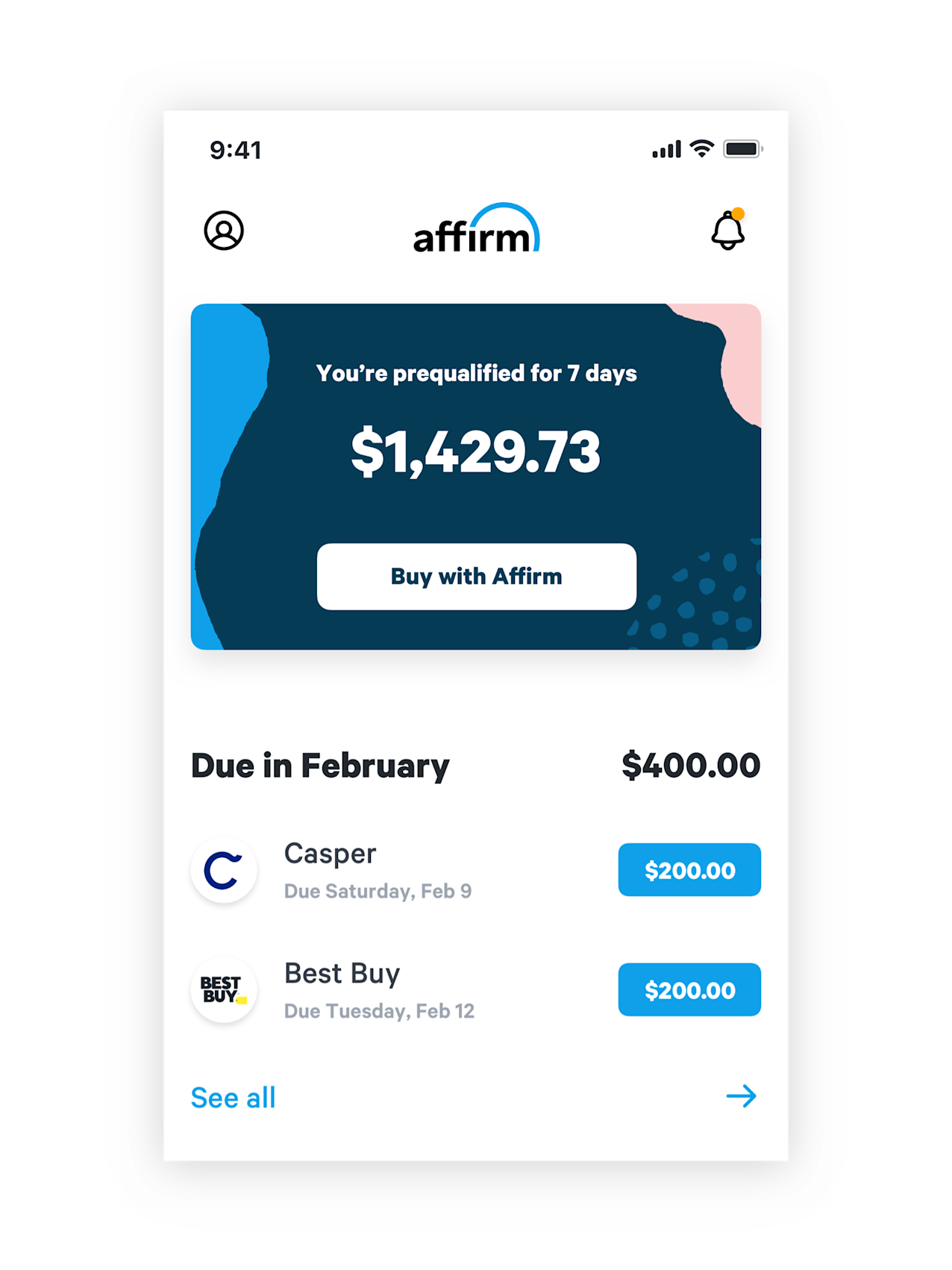

- Affirm reminds you by email and SMS before your upcoming payment is due. Enable Autopay to schedule automatic monthly payments on your loan.

- Be 18 years or older (19 years or older in Alabama or if you’re a ward of the state in Nebraska).

- Not be a resident of Iowa (IA) or West Virginia (WV).

- Provide a valid U.S. or APO/FPO/DPO home address.

- Provide a valid U.S. mobile or VoIP number and agree to receive SMS text messages. The phone account must be registered in your name.

- Provide your full name, email address, date of birth, and the last 4 digits of your social security number to help us verify your identity.

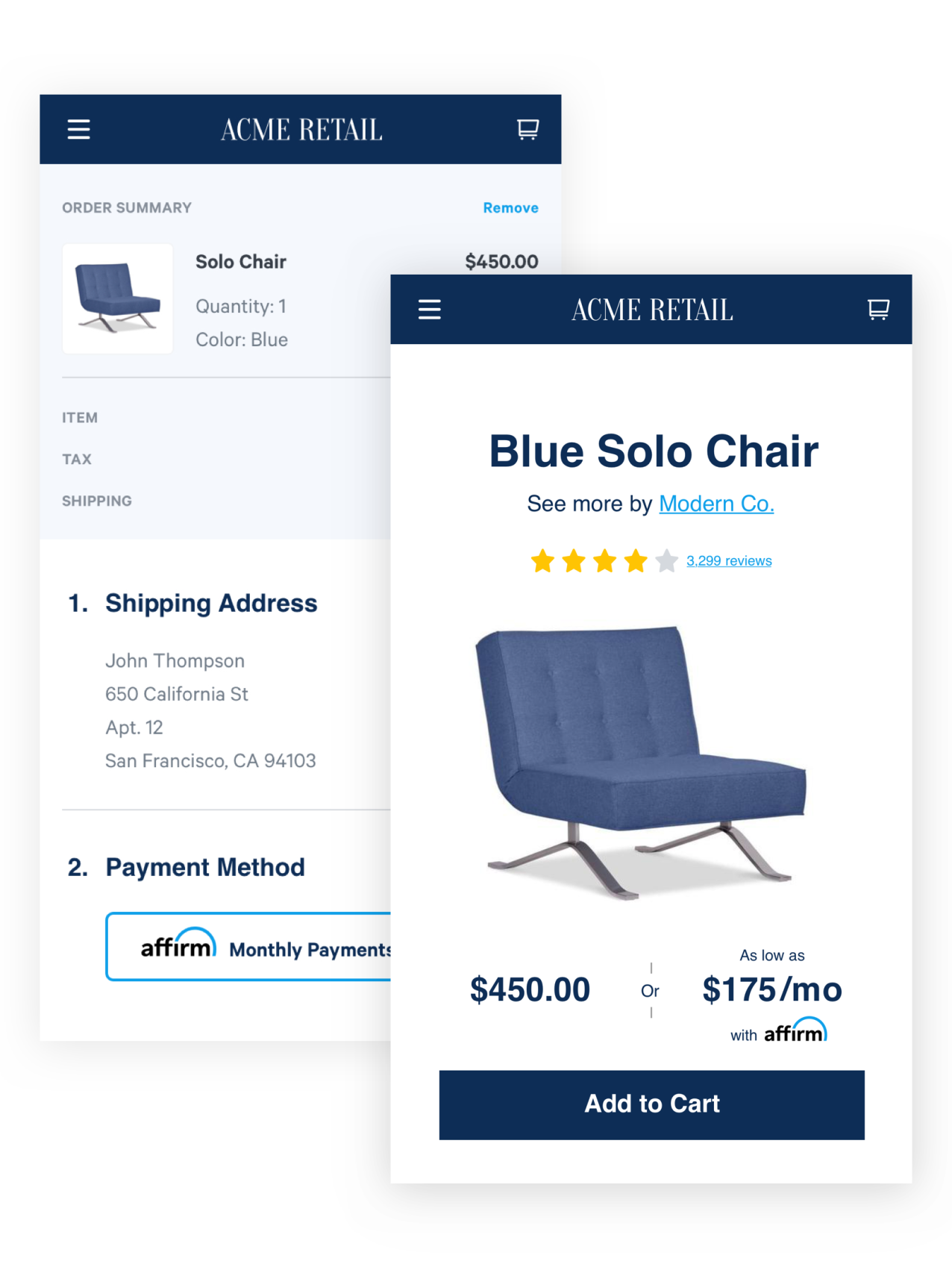

- At checkout, choose Pay with Affirm.

- Affirm prompts you to enter a few pieces of information: Name, email, mobile phone number, date of birth, and the last four digits of your social security number. This information must be consistent and your own.

- To ensure that you’re the person making the purchase, Affirm sends a text message to your cell phone with a unique authorization code.

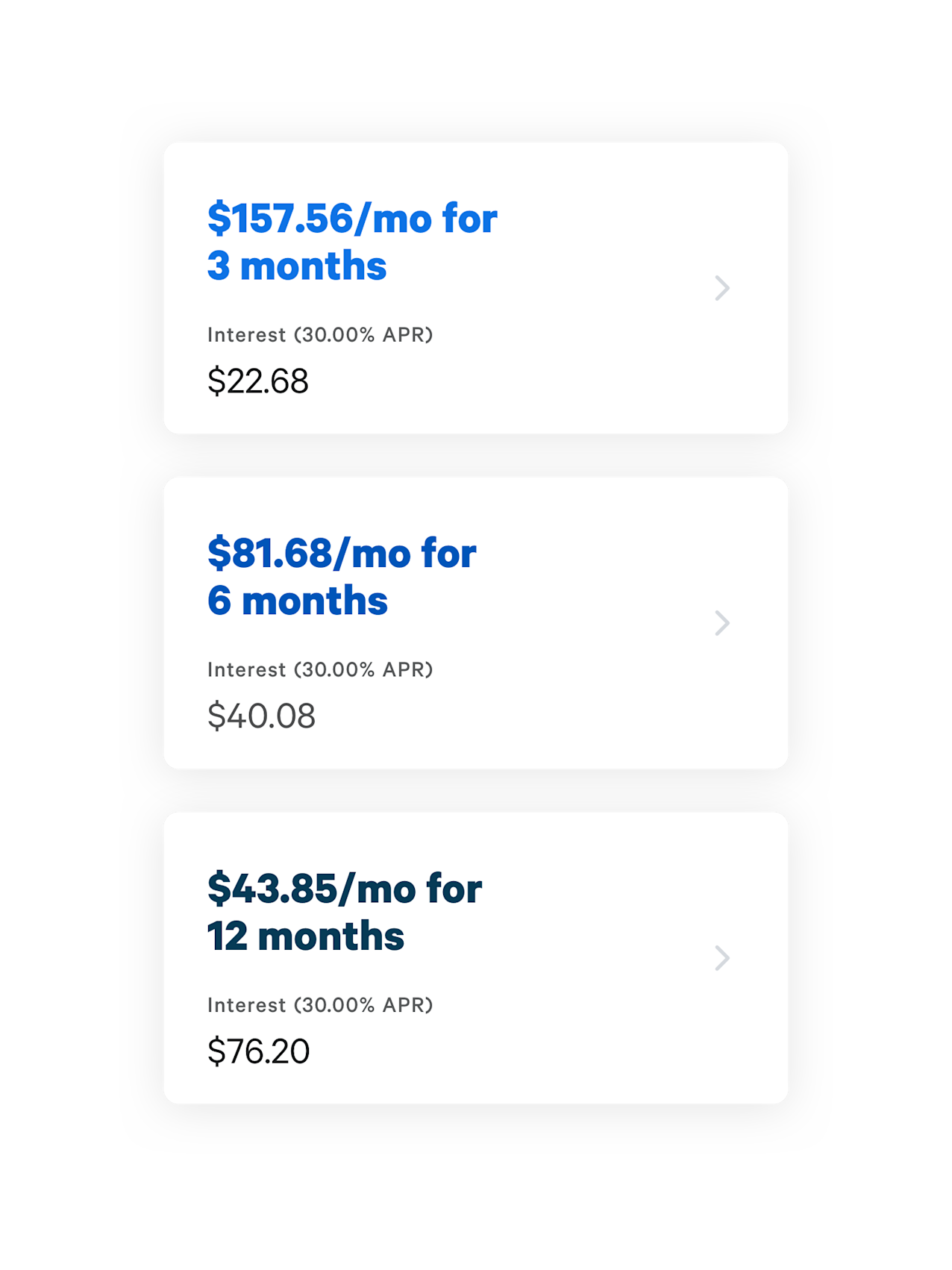

- Enter the authorization code into the application form. Within a few seconds, Affirm notifies you of the loan amount you’re approved for, the interest rate, and the number of months you have to pay off your loan. You have the option to pay off your loan over three, six, or twelve months. Affirm states the amount of your fixed, monthly payments and the total amount of interest you’ll pay over the course of the loan.

- To accept Affirm’s financing offer, click Confirm Loan and you’re done.

- Affirm asks for a few pieces of personal information: Name, email address, mobile phone number, date of birth, and the last four digits of your social security number.

- Affirm verifies your identity with this information and makes an instant loan decision.

- Affirm bases its loan decision not only on your credit score, but also on several other data points. This means that you may be able to obtain financing from Affirm even if don’t have an extensive credit history.

Affirm is a better way to buy

One specifically designed to help you say yes to the things you want while keeping you out of unhealthy debt.

We tell you up front the total amount you’ll pay. That number will never go up.

You choose the payment schedule that works for you.

We won’t charge you late fees or penalties of any kind, ever.

Because life could use a little more yes

So you can take that trip, or set up that new mattress, or ace that interview, and feel really great about your purchase—all while staying true to your financially responsible self.

How It Works:

Fill your cart

Choose from thousands of sites and stores. Just select Affirm at checkout, then enter a few pieces of information for a real‑time decision

Choose how to pay

Select the payment schedule you like best, then confirm your loan. We’ll never charge more than you see up front.

Make easy monthly payments

Just download the Affirm app or sign in at affirm.com. We’ll send you email and text reminders whenever a payment’s coming up.

Interest Rates and Fees

Making Payments and Refunds

- Go to www.affirm.com/account.

- Enter your mobile phone number. Affirm sends a personalized security PIN to your phone.

- Enter this security PIN into the form on the next page and click Sign in.

- After you sign in, a list of your loans appears, with payments that are coming due. Click the loan payment you would like to make.

- Make a payment using a debit card or ACH bank transfer.

Curious about your credit score?

Your credit score will not be affected when you check your eligibility, even though we perform a credit check. If you decide to buy with Affirm, your loan and payments may affect your credit score. Paying on time can help you build positive credit history.

How do I get a refund?

Please contact the store where you bought your item to request a refund. They can let you know if a return is possible and how much the refund will be, according to their own return policy.

After they process the refund, the refund amount will show up in your account within 3–45 business days, and your balance will be updated.

Monthly payments

While you’re waiting for your refund, please continue to make any monthly payments that are due.

Refund is less than balance

Dispute Resolution Process

Overview

- Customers can open a dispute within 60 calendar days of capture, during which time, they are not responsible for making payments.

- Both customers and merchants have 15 calendar days to provide evidence to substantiate their claims.

- After providing all evidence, Affirm will notify the customer of a decision within 15 calendar days

Affirm Customer Dispute Resolution Procedures

- Product not received. Customer claims that they have not received a product they purchased on Merchant’s website.

- Product unacceptable. Customer claims that a product they received is incorrect, damaged, or otherwise fails to conform to the product description on the Merchant’s website.

- Cancelation or return not processed. Customer claims that they were charged for a product or service they canceled or returned in a manner consistent with Merchant’s stated refund and return policy in effect at the time of Customer’s purchase.

- Incorrect charge. Customer claims that they were charged an incorrect amount.

- Duplicate charge. Customer claims they were charged multiple times for an item or an order.

If your refund is less than your total purchase balance, it might not lower your next monthly payment. Instead, you can expect fewer monthly payments, a smaller final payment, or both.

Refund is more than balance

If your refund is more than your purchase balance, you’ll get back the difference, minus any interest you’ve paid. We’ll credit your payment method within 3–10 business days.

DISCLOSURE

“

Loans through Affirm are made by Cross River Bank, Member FDIC; Celtic Bank, Member FDIC; or Affirm Loan Services, LLC.

California residents: Affirm Loan Services, LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law license 60DBO-111681

" to "Payment options are offered by Affirm, are subject to an eligibility check, and may not be available in all states. California residents: Affirm Loan Services, LLC is licensed by the Department of Business Oversight. Loans are made or arranged pursuant to California Financing Law license 60DBO-111681."